Mergers & fusions

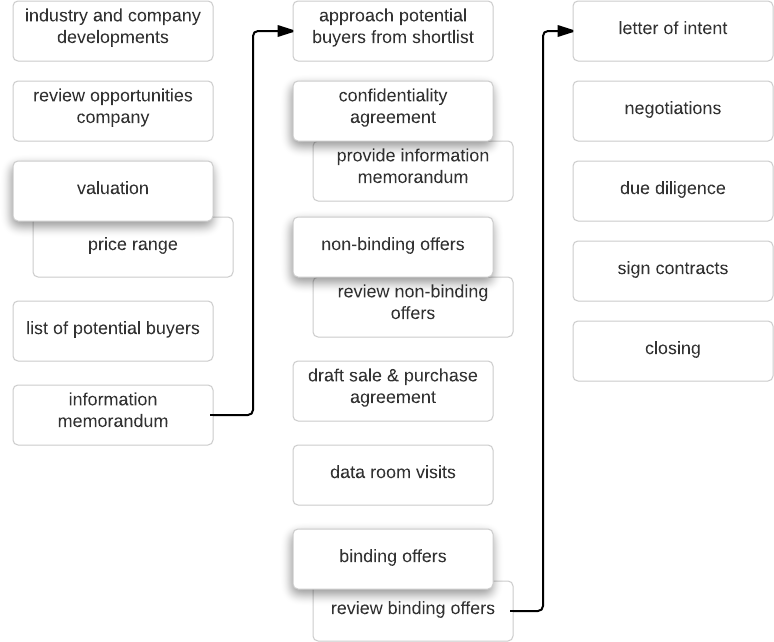

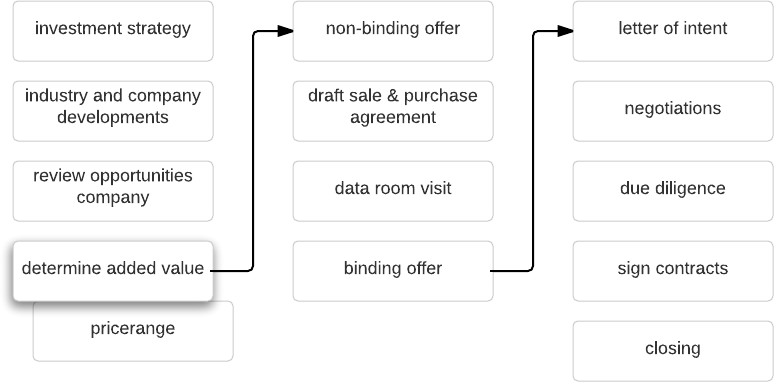

Buying, selling or financing are all transactions whereby the interaction between people determines the final success. Clients play an active part in this. Key is to propose the right mix of the client’s wishes and opportunities, at the right time to the right partners.

Value Creation enhances the valuation and price setting of companies or company activities with help of the Value Creator™ process.